“Solution” to high property taxes is… more higher taxes!

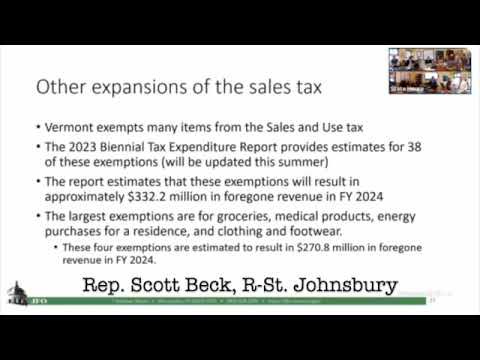

Dems looking at higher sales taxes, sweetened beverage tax, food & clothing tax, cloud tax...

Since attaining supermajority status in Montpelier, the Democrats’ education policy can be explained as “give the government school monopoly (the VTNEA, superintendents association, etc.) whatever they want!” This included universal “free” school meals, expanded pre-k spending and control over birth to five care, and a new pupil weighting system guarant…

Keep reading with a 7-day free trial

Subscribe to Behind the Lines: Rob Roper on Vermont Politics to keep reading this post and get 7 days of free access to the full post archives.