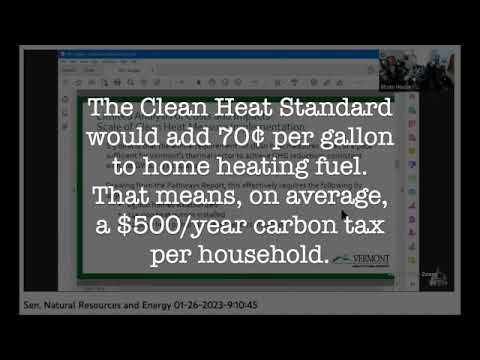

Clean Heat Standard will have Vermonters paying 70¢/gal. more to heat their homes – at least.

A $500/year "carbon tax" for the average household.

Secretary of Natural Resources, Julie Moore, pulled back the veil on what the cost of the proposed Clean Heat Standard, S.5, would cost Vermonters, and it’s a really big check.

Moore calculates that the $2 billion-plus program over the remainder of the decade will mean an additional 70¢ per gallon for home heating fuels. Given that the average Vermont ho…

Keep reading with a 7-day free trial

Subscribe to Behind the Lines: Rob Roper on Vermont Politics to keep reading this post and get 7 days of free access to the full post archives.